Contact us

About us

At Good Life Homes, we have a simple business approach:

"To treat all clients in the manner we would like to be treated ourselves".

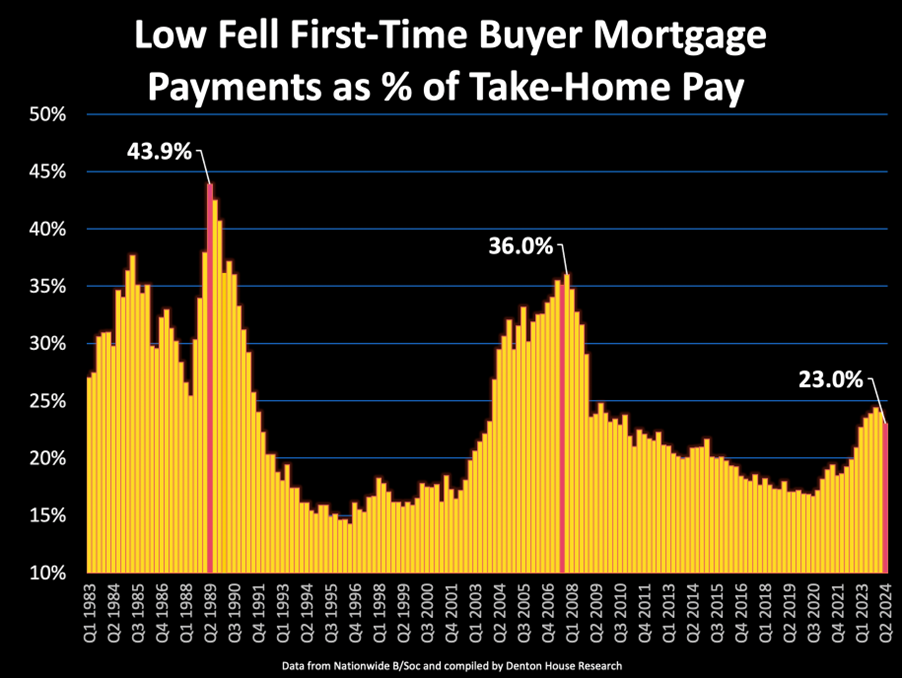

It might surprise many that, despite significant inflation over the past few years, buying a house today is still more affordable as a percentage of take-home pay.

The average value of a typical Low Fell first-time buyer property has surged by 328.5% since 1989 (35 years ago), reaching £202,800 in 2024. So, the title of this article sounds wrong.

Yet the headline price one pays for your home is almost irrelevant. Indeed, it is what it costs each month out of one's salary. You see, despite this increase in house prices, the monthly mortgage payments that first-time buyers in Low Fell need to make today are significantly lower as a proportion of their take-home pay compared to 1989.

According to data from the Nationwide Building Society, today's first-time buyers in Low Fell spend 23.0% of their household take-home pay on mortgage payments, a substantially lower amount than the 43.9% required in 1989. This is because wages were lower, and the Bank of England's base rate was 14.88%. This represents a 47.6% reduction in the financial burden of monthly mortgage payments today for Low Fell first-time buyers compared to 1989.

One might argue that 1989 was long ago and irrelevant to today's economic climate. I would disagree. However, a more recent comparison from 2007 reveals that first-time buyers in Low Fell had to allocate 36.0% of their household income to mortgage payments. This is still 36.1% higher than today's figures, underscoring the improved property affordability in Low Fell over the past few decades.

So why has this happened? Real incomes (after inflation) have risen, and interest rates are much lower. That is true.

UK household incomes have grown in real terms in the last 35 years by 25.02% (i.e., after inflation), while interest rates are at 5.25%

Yet the improved affordability of housing in Low Fell for first-time buyers is influenced by several factors beyond lower interest rates and increased household incomes. One significant aspect is the overall change in the housing market dynamics, including government policies, the availability of mortgages, and demographic shifts.

UK Government Policies and Mortgage Availability

Government policies supporting first-time buyers, such as Help to Buy schemes and favourable mortgage products, have made homeownership more accessible. These policies often provide financial assistance or guarantee parts of the mortgage, reducing the initial financial barriers for first-time buyers. Moreover, the availability of competitive mortgage products with lower interest rates and longer repayment terms (over 30 and 35 years) has eased the burden on first-time buyers.

Demographic Shifts and Urban Development in Low Fell

Demographic changes, including the growth of urban areas and improved infrastructure, have also contributed to the housing market's evolution. With its strategic location and improved transport links, Low Fell has become an attractive option for commuters and young families. This has increased demand for housing, driving development projects that cater to the needs of first-time buyers with affordable housing options.

Rent vs. Buy in Low Fell: Economic Considerations

As new rental prices continue to rise at an alarming rate, the economic advantage of buying over renting becomes more pronounced. Renting often involves annual rent increases, offering no long-term financial security. In contrast, buying a home with a fixed-rate mortgage provides predictability in monthly payments and the potential for property value appreciation.

However, many people will counter that by saying first-time buyers must find large deposits. The average first-time buyer deposit in 2023 was an eye-watering £53,414. Remember, though, that this is just an average, and 95% mortgages (meaning a 5% deposit would need to be found) have been available for over 14 years and are comparatively easy to obtain with a decent credit history! Of course, a large deposit (25%) will get to a lower interest rate (at the time of writing, the best 95% mortgage/5% deposit was at 5.2%, versus a 75% mortgage/25% deposit mortgage at 4.24%), yet if one extends the number of years one has for the mortgage, then the monthly payments will come down. (Remember to take advice from someone qualified to advise you on this).

One advantage is that homeowners build equity, which can be a significant financial asset over time, whereas renters do not gain any ownership benefits despite continuous payments.

If you don't buy a home, once you retire and have no significant assets, you should receive support from the government for your rental payments. However, as your family will have probably flown the nest by the time you retire, you will only qualify for support for a smaller home (meaning you will either need to move home when you reach retirement or supplement the rent from personal funds).

Final Thoughts

The Low Fell property market has seen a roller coaster shift in affordability for first-time buyers over the past 35 years. While property prices have increased substantially, the proportion of household income required for mortgage payments has decreased due to lower interest rates, real-term income growth, and supportive government policies. This improved affordability, combined with the rising cost of rent, makes buying a more attractive and financially sound option for many.

The economic landscape has changed significantly, favouring first-time buyers in ways that were impossible in 1989 or even 2007. As the market continues to evolve, first-time buyers in Low Fell can take advantage of the current conditions to secure their financial future through homeownership. The reduced financial burden and the potential for long-term gains make now a suitable time for those considering stepping onto the property ladder.

At Good Life Homes, we have a simple business approach:

"To treat all clients in the manner we would like to be treated ourselves".