Contact us

About us

At Good Life Homes, we have a simple business approach:

"To treat all clients in the manner we would like to be treated ourselves".

Are you a homeowner in Low Fell? Perhaps you’re planning to move/sell/buy within the next six to twelve months, or maybe you're on the lookout for your next dream home and have no timescales. Whether you're buying or selling, having a clear understanding of the current state of the property market in Low Fell is vital to make informed choices.

You might be an investor in the Low Fell buy-to-let sector, contemplating selling or expanding your portfolio. Or perhaps you’re a Low Fell first-time buyer wondering if now is the right time to jump onto the market. Regardless of your situation, knowing whether the property market in Low Fell favours buyers or sellers can significantly influence your strategy.

By closely examining the latest data for the Low Fell property market, we can gain insight into price trends, market conditions, and the overall sentiment, helping everyone - whether buying, selling, investing, or making their first purchase - plan effectively.

What Kind of Property Market Does Low Fell Have Right Now?

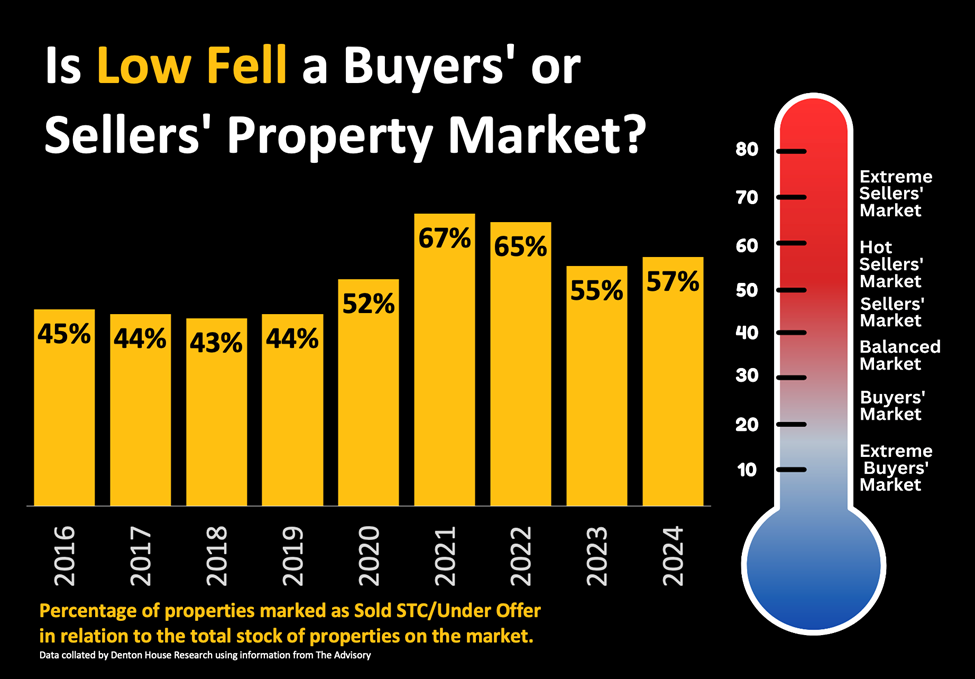

For those familiar with my previous analyses on the Low Fell property market, you’ll know that one of the best ways to determine whether it’s a buyer’s, seller’s, or balanced market is by looking at the ratio of properties marked as “Sold STC” or “Under Offer” compared to the total number of properties available for sale.

For example, if 41 properties are marked as "Sold STC" out of 100 available, then the market is operating at 41%. This ratio isn't just a random figure - it’s a reflection of the overall sentiment in the market.

Here’s how those percentages break down:

• Extreme Buyer’s Market (0%-20%): Buyers hold all the cards.

• Buyer’s Market (21%-29%): Buyers have the upper hand but not as strongly.

• Balanced Market (30%-40%): A stable equilibrium between buyers and sellers.

• Seller’s Market (41%-49%): Sellers begin to gain the upper hand.

• Hot Seller’s Market (50%-59%): Strong competition among buyers.

• Extreme Seller’s Market (60%+): Sellers dominate, with properties moving fast.

These benchmarks play a critical role, influencing everything from listing prices to negotiating leverage.

The Current Snapshot of the Low Fell Property Market

Utilising the table above, these are the statistics for the Low Fell property market (NE9) for every October (as the Low Fell property market is cyclical – it’s important to compare the same month).

• Oct-16 - 45%

• Oct-17 - 44%

• Oct-18 - 43%

• Oct-19 - 44%

• Oct-20 - 52%

• Oct-21 - 67%

• Oct-22 - 65%

• Oct-23 - 55%

• Oct-24 - 57%

As is expected, it was a stronger market for Low Fell sellers in the post Covid years, yet things have settled down now to levels seen before the pandemic, this current percentage of 57% puts us in a hot sellers’ market.

What This Means for Low Fell Sellers

Whilst it is better than 2023, if you're looking to sell your property in Low Fell, the current market conditions require more patience and flexibility than 2021. The days of properties flying off the market within days or weeks are mostly behind us, meaning sellers need to prepare for longer marketing periods.

Pricing your home realistically is more important than ever. While Low Fell sellers enjoyed a particularly strong market in 2021 and 2022, where demand often outstripped supply, the situation has since shifted. The probability of your home selling has decreased compared to recent years.

In the 12 months up to the middle of October 2023, 71.01% of properties in Low Fell that were on the market sold and completed (the rest withdrew unsold).

However, in the 12 months up to the middle of October 2024, that percentage rose slightly to 71.13%, meaning there are still plenty of homes sitting unsold or being withdrawn from the market altogether.

To give this context, the UK average has seen a slight decline, with the national completion rate dropping from 55.56% to 53.22% in the same period.

In light of these changes, your marketing approach should be well thought out. Utilising digital tools such as virtual tours, video marketing, and targeted social media campaigns can give your property a competitive edge. These strategies help attract more serious buyers in a market where securing interest is becoming increasingly challenging.

What This Means for Low Fell Buyers

For buyers, particularly in sought-after parts of Low Fell, the competition remains fierce. Securing a mortgage agreement in principle will give you a significant advantage in this competitive environment. Additionally, broadening your search area may help you find properties that others have overlooked, leading to better deals.

In less competitive areas, buyers have more room to negotiate. You’ll likely find more flexibility on price and even some extras, such as fixtures, fittings, or other incentives thrown in by sellers eager to close a deal. The pressure to make quick decisions is reduced, allowing you more time to thoroughly consider your options.

It’s also worth remembering that most sellers are also buyers, so any loss you may experience on the sale side should be offset by a better deal on your next purchase.

External factors such as global economic trends, events, inflation, and interest rates will continue to influence the Low Fell property market in the coming months. Keeping an eye on these trends is essential for buyers and sellers alike.

Final Thoughts

As we enter November 2024, the Low Fell property market presents both opportunities and challenges for buyers and sellers. Understanding the subtle shifts in market dynamics is crucial for anyone planning a move, whether you're a seasoned investor, a first-time buyer, or looking to relocate within the area.

Staying flexible, informed, and prepared will make all the difference in navigating this market. The experience of moving is as much about the journey as it is about reaching your destination.

At Good Life Homes, we have a simple business approach:

"To treat all clients in the manner we would like to be treated ourselves".